20+ Reverse amortization

August 25 2022. The calculators are made available to you as self-help tools for your independent use and are not intended to provide financial advice.

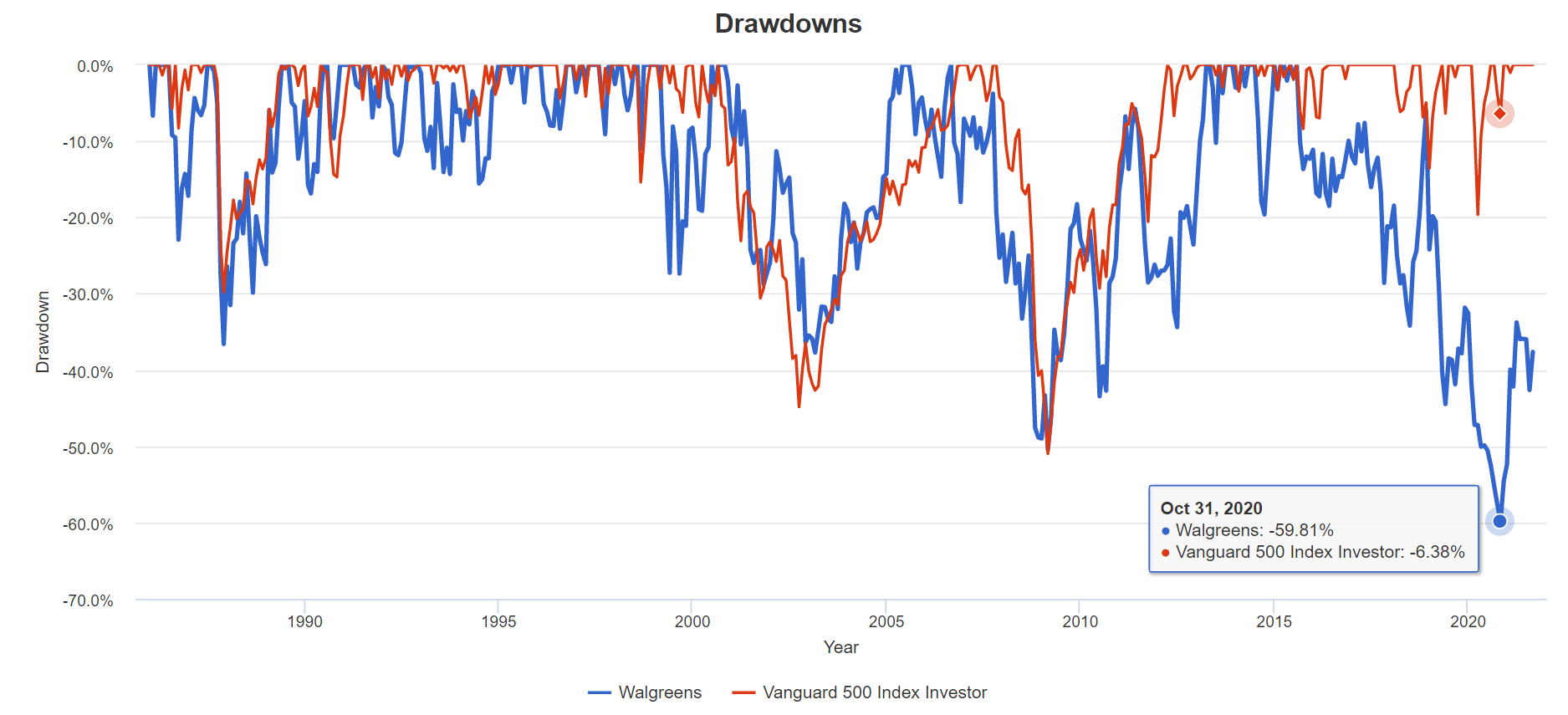

4 Reasons Walgreens Is One Of The Best Dividend Retirees Can Buy Today Nasdaq Wba Seeking Alpha

Simply put an amortization schedule is a table showing regularly scheduled payments and how they chip away at the loan balance over time.

. Amortization is the paying off of debt with a fixed repayment schedule in regular installments over a period of time for example with a mortgage or a car loan. Fixed length payouts are usually paid in monthly installments. Amortization schedules also will typically show.

If your interest rate is 5 percent your monthly rate would be 0004167 005120004167. Dont Waste Time Anywhere Else Find Out If A Reverse Mortgage Is Right For You Today. Law the value of these assets can.

A reverse mortgage amortization schedule might also include the homes projected value. Refinance your home loan today to get a lower monthly payment or consolidate debt. It also refers to.

Please enter the interest rate. Lets say you took out a reverse mortgage at age 62 the first year of eligibility and opted to receive a lump sum advance of 100000 to help pay for renovations to your home to make it. Term of Loan.

Ad Our New Online Calculator Will Get You The Reverse Mortgage Info You Need Right Away. Payment Amount Principal Amount Interest Amount. Retirement Withdrawal Calculator Terms and Definitions.

Please enter the term length of the loan in years. These costs include title fees appraisal fee credit report counseling wire fee and so on. It is based on the idea that the cost of an asset decreases.

Reverse amortization is a financial accounting technique used to calculate the cost basis of an asset. We cannot and do not. Say you are taking out a mortgage for 275000 at 4875 interest for 30 years 360 payments made monthly.

Expected Retirement Age This is the age at which you plan to retire. Amount You Expected to Withdraw This is the budgeted. Home Resources Calculators Reverse Loan Calculator.

Monthly Payment Interest Rate. For example an annuitant aged 60 who selects a 10-year period certain payout will be guaranteed payments until around age 70. The HECM program insures reverse mortgages so even if the loans value exceeds the.

Under Section 197 of US. Subtract that from your monthly payment to get your principal payment. Ad Although HARP has expired Quicken Loans still has other options you may qualify for.

Amortization as a way of spreading business costs in accounting generally refers to intangible assets like a patent or copyright. I would do it in excel and as you suggest you can set it out in columns. If Im understanding you correctly this is fairly simple no need for any special functions.

Multiply 150000 by 3512 to get 43750. Number of payments over the loans lifetime Multiply the number of years in your loan term by. For the origination fee reverse mortgage lenders are allowed to charge you up to 6500 depending on.

Thats your interest payment for your first monthly payment.

Ex 99 1

Is It Better To Buy A Home And Pay 20 Years Of Loan With Stress Of Emi Or Sip With Rented House Quora

Home Equity Loan Calculator Mls Mortgage Home Equity Loan Calculator Mortgage Amortization Calculator Home Equity Loan

Have A Need For Financing Call Me Today To Discuss At 503 614 1808 Thebrokerlist Blog

Downloadable Free Mortgage Calculator Tool

2

Have A Need For Financing Call Me Today To Discuss At 503 614 1808 Thebrokerlist Blog

Are Reverse Mortgages America S Most Hated Loan

Ex 99 1

Have A Need For Financing Call Me Today To Discuss At 503 614 1808 Thebrokerlist Blog

Downloadable Free Mortgage Calculator Tool

Ex 99 1

Is Paying 20years Tenure Housing Loan In 10 Years Same As 30 Years Tenure Loan In 10 Years With Same 8 65 Interest Rate Principal Amount Is 48l Quora

Ocn091 V1 Jpg

The World S Largest And Cheapest Reverse Osmosis Desalination Plant Is Download Scientific Diagram

/dotdash_INV_final-The-Risks-of-Mortgage-Backed-Securities-Mar_2021-01-d9076937fc9944049f46c85c78098e39.jpg)

The Risks Of Mortgage Backed Securities

/dotdash_INV_final-The-Risks-of-Mortgage-Backed-Securities-Mar_2021-01-d9076937fc9944049f46c85c78098e39.jpg)

The Risks Of Mortgage Backed Securities